South Sudan

National Revenue

Authority

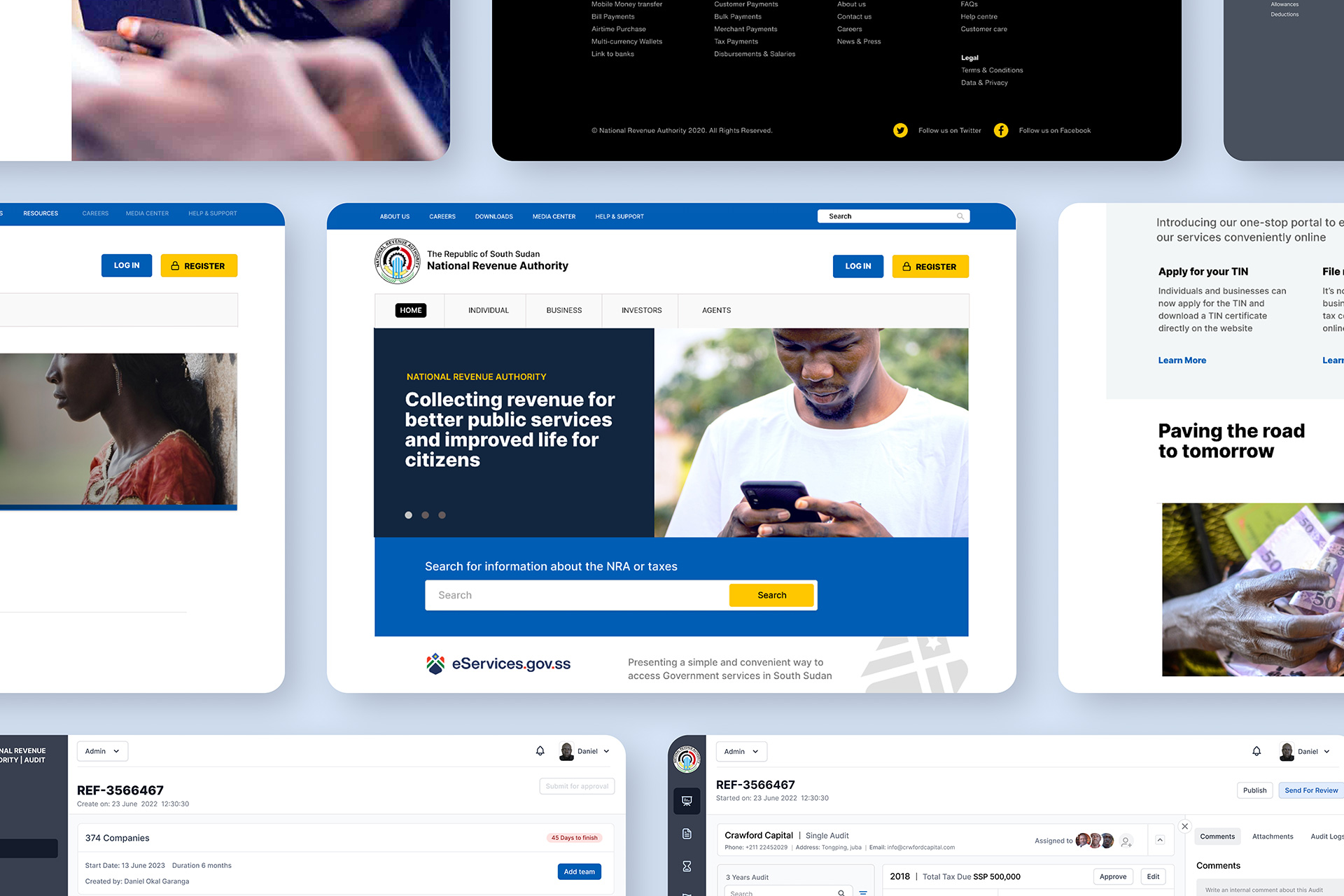

Project Overview

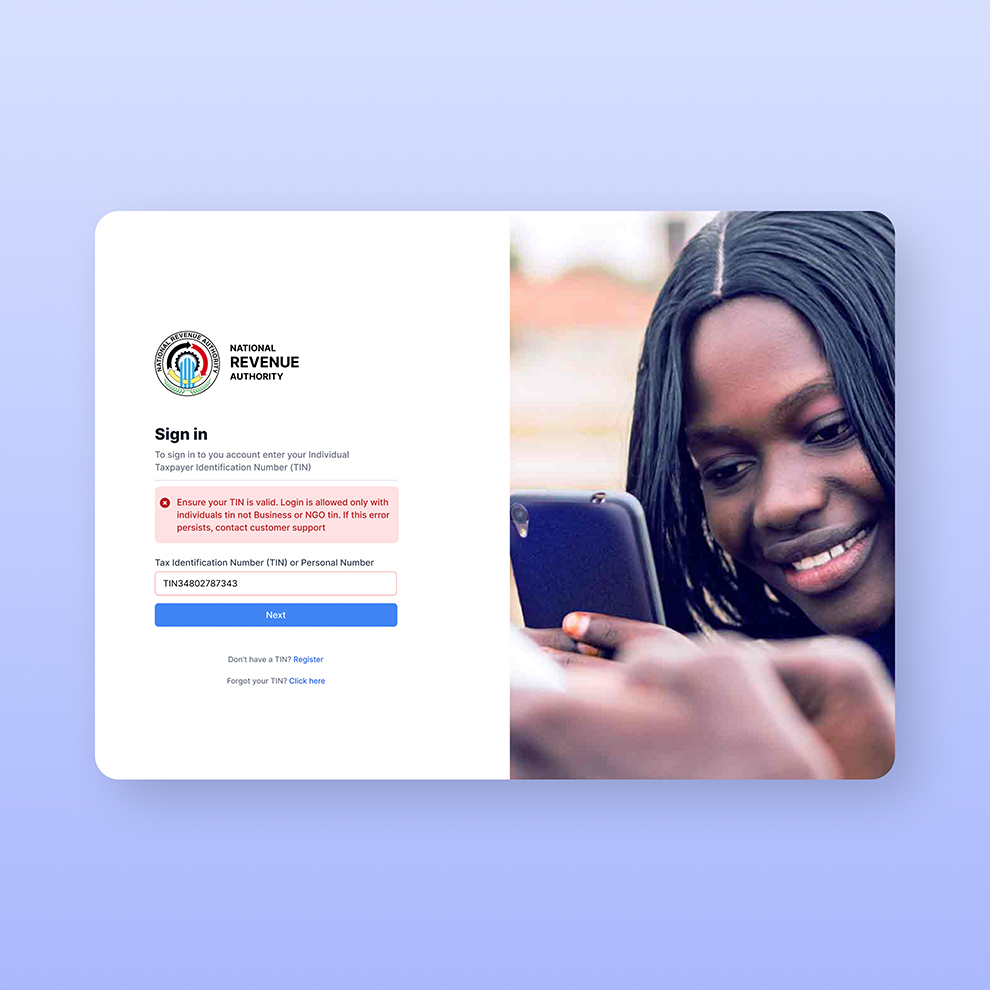

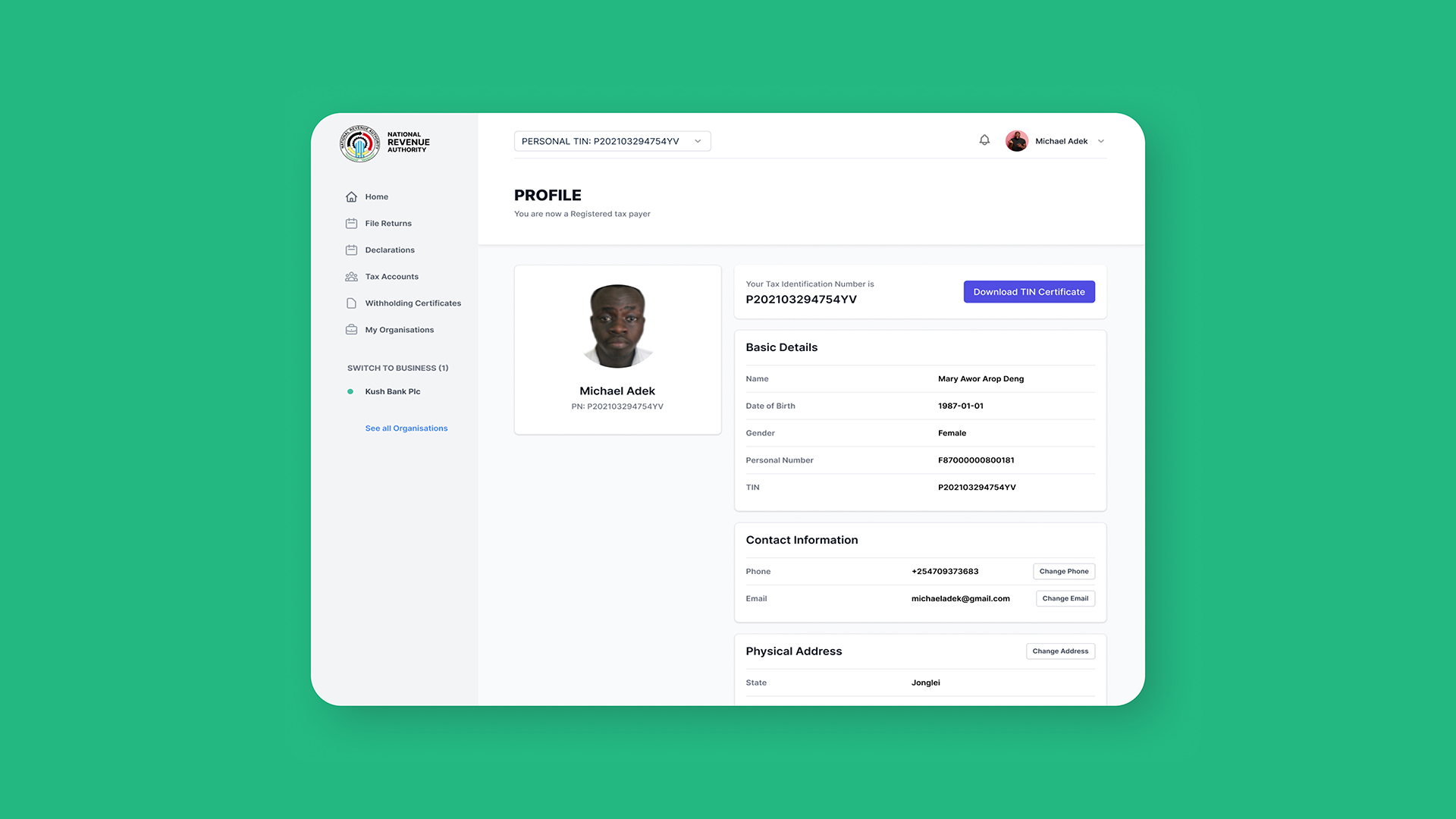

The National Revenue Authority (NRA) of South Sudan plays a crucial role in the country's economic development by collecting taxes efficiently and effectively. However, the previous tax collection system faced usability and accessibility challenges.

This UX case study outlines the process of redesigning the NRA's tax collection website to enhance user experience and increase tax compliance.

Research

and discovery

User interviews

& competitor analysis

We conducted user interviews with taxpayers, tax professionals, and NRA staff to identify pain points, while also analyzing existing user data and feedback to uncover common issues. In addition, we studied tax collection websites and platforms from other countries for best practices and identified features that could be adapted to enhance the NRA's platform.

The analysis revealed a deficiency in user-friendliness and accessibility of the tax collection platform, leading to a lower rate of tax compliance. Users faced challenges in navigating the website, understanding tax regulations, and making convenient payments.

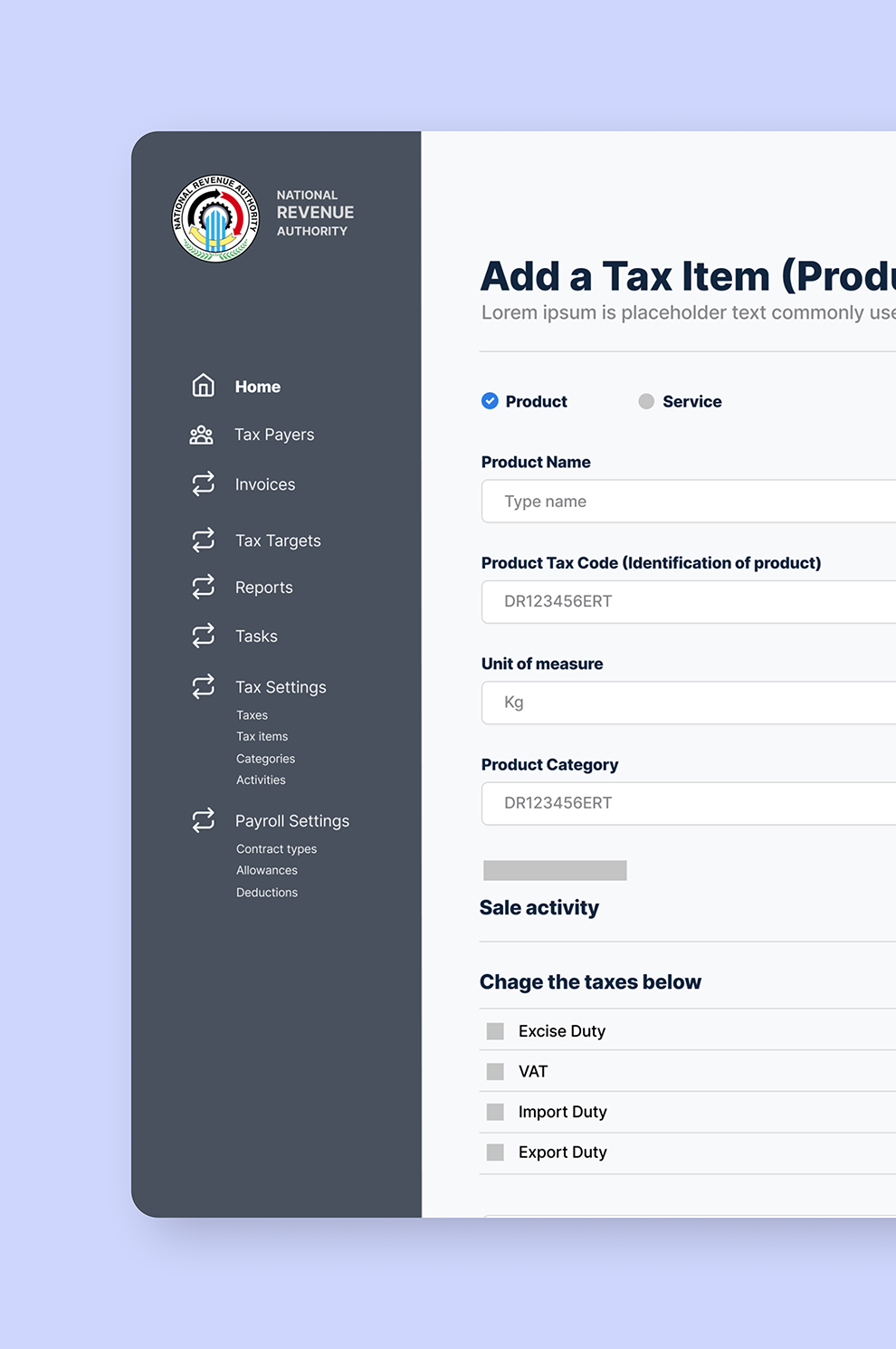

Design

and development

Language, Architecture

& User testing

I overhauled the website's information architecture to enhance intuitive navigation, simplifying language and offering clear explanations of tax regulations. Following this redesign, we conducted user testing sessions with representative users to validate the new design and features.

Feedback from these sessions was gathered and necessary adjustments were made to ensure that the platform remained user-friendly, efficient, and met security standards.

Launch

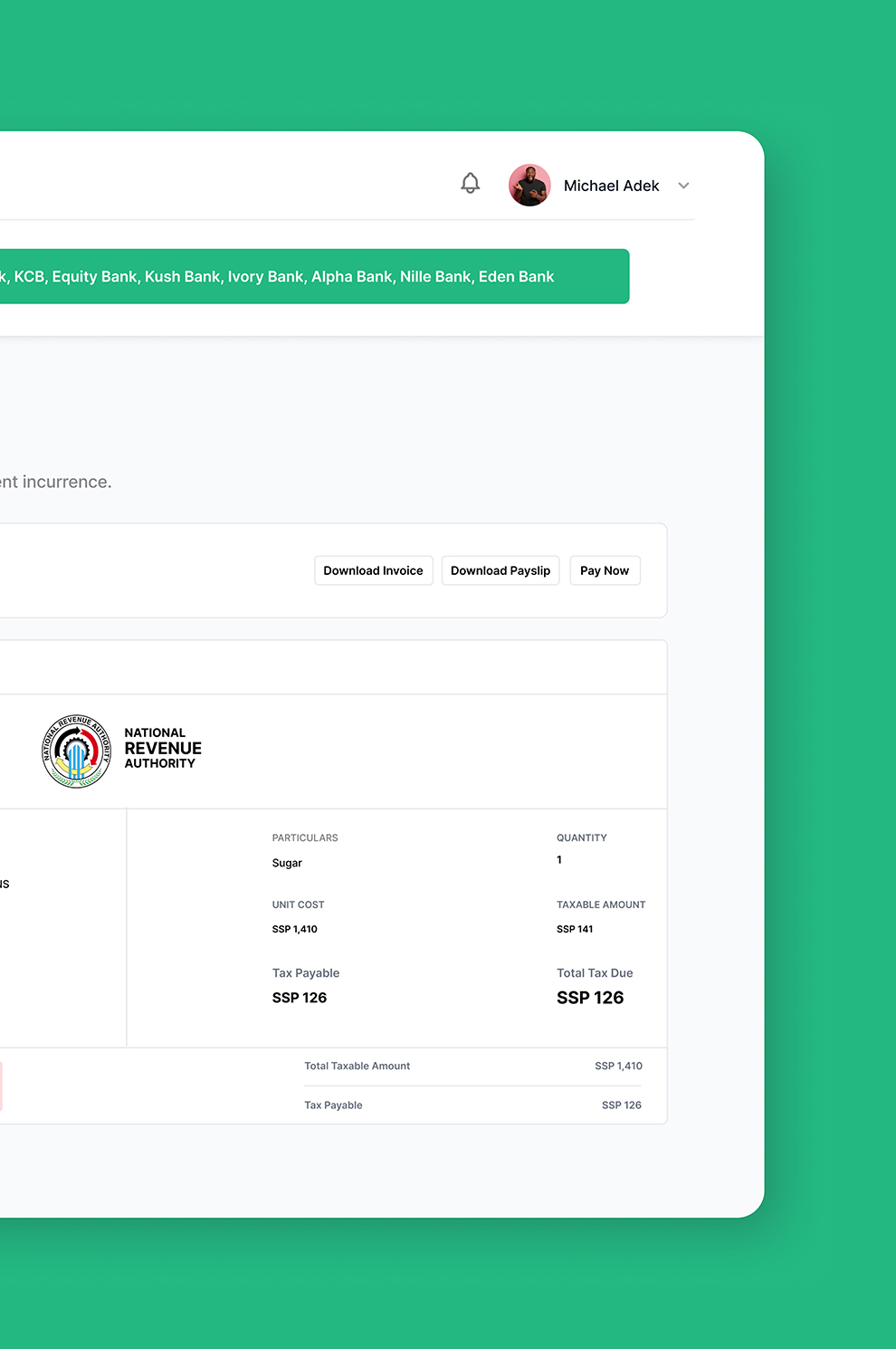

and deployment

The redesigned tax collection platform was launched in phases to ensure a smooth transition. Comprehensive training sessions were organized for NRA staff, taxpayers, and tax professionals to familiarize them with the new system.

Conclusion

A user-centered approach to redesigning the tax collection platform for the National Revenue Authority of South Sudan led to improved user experience, increased tax compliance, and enhanced accessibility.

The collaboration between UX designers, developers, and stakeholders played a pivotal role in achieving these positive outcomes. Continued user feedback and iterative improvements will be essential to maintain the platform's effectiveness in the long term.