A digital financing platform

ImaliPay

Project Overview

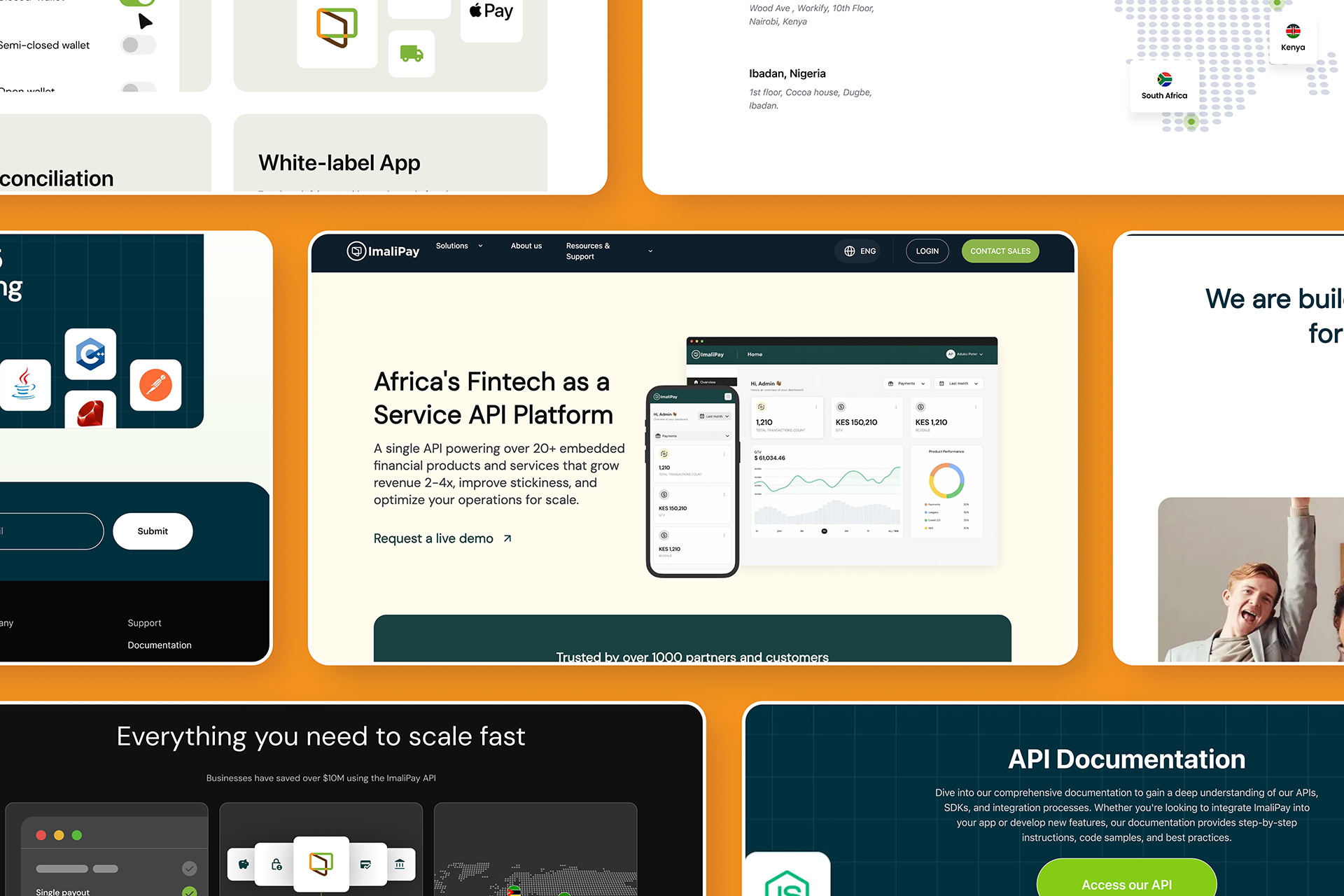

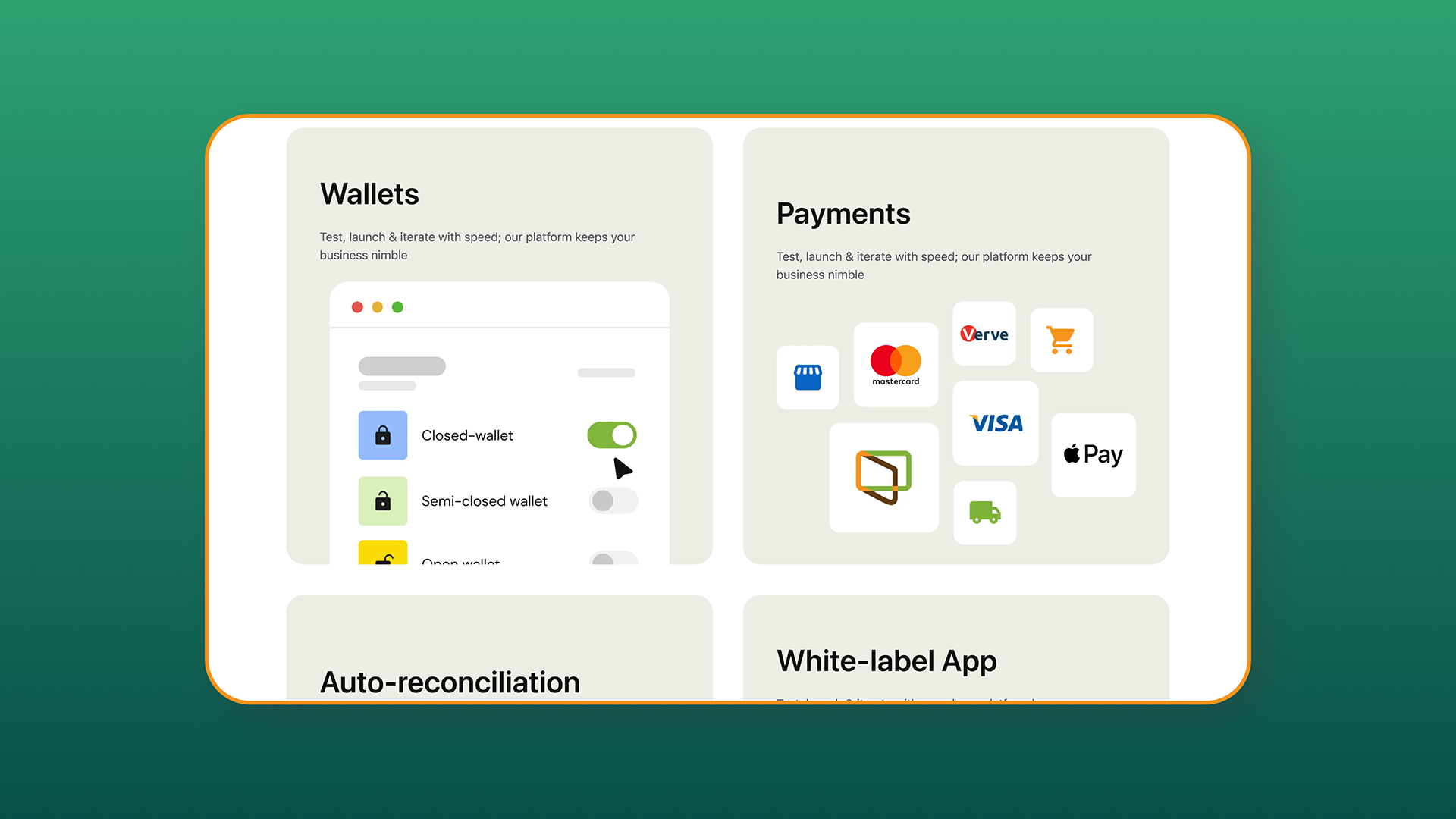

ImaliPay aims to provide a seamless and user-friendly experience to help businesses access various financial services and resources, thereby fostering economic growth and financial inclusivity across the continent.

The platform empowers businesses across Africa with the financial services tools they need to succeed in both local and global markets.

Problem statement

Many small and medium-sized businesses in Africa face significant barriers when it comes to accessing financial services and resources. This includes challenges related to banking, loans, payment processing, and international transactions. Additionally, a lack of financial literacy and awareness further compounds the problem.

The objective is to create a digital platform that simplifies and streamlines access to financial services for businesses, enabling them to thrive and compete effectively in both local and global markets.

Target audience

The primary target audience for the platform includes small and medium-sized businesses (SMEs) across various industries in Africa. This includes entrepreneurs, business owners, and financial managers who seek to improve their business operations, access capital, and expand their market reach.

Research

and discovery

User challenges

In researching the needs and challenges of African businesses in accessing financial services, we found a notable lack of banking infrastructure, hindering essential financial services.

Costly cross-border payment processing and currency conversion further impede international trade participation. Many businesses lack financial literacy, and security concerns in online transactions pose a significant obstacle to adopting digital financial services.

Design goals

Based on the research insights, I established design goals to address the challenges and create a meaningful user experience.

User flow

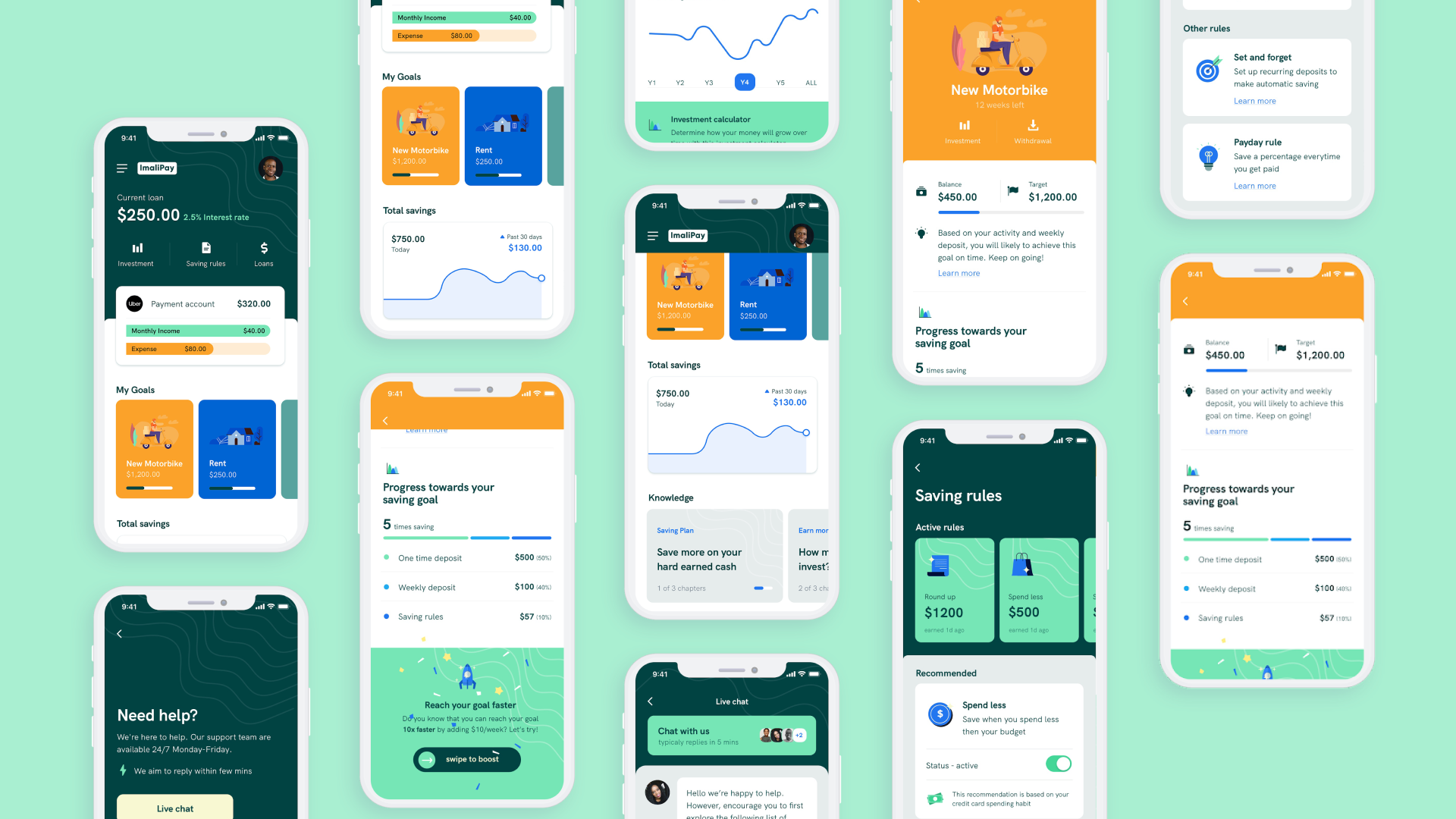

Visual design

and experience

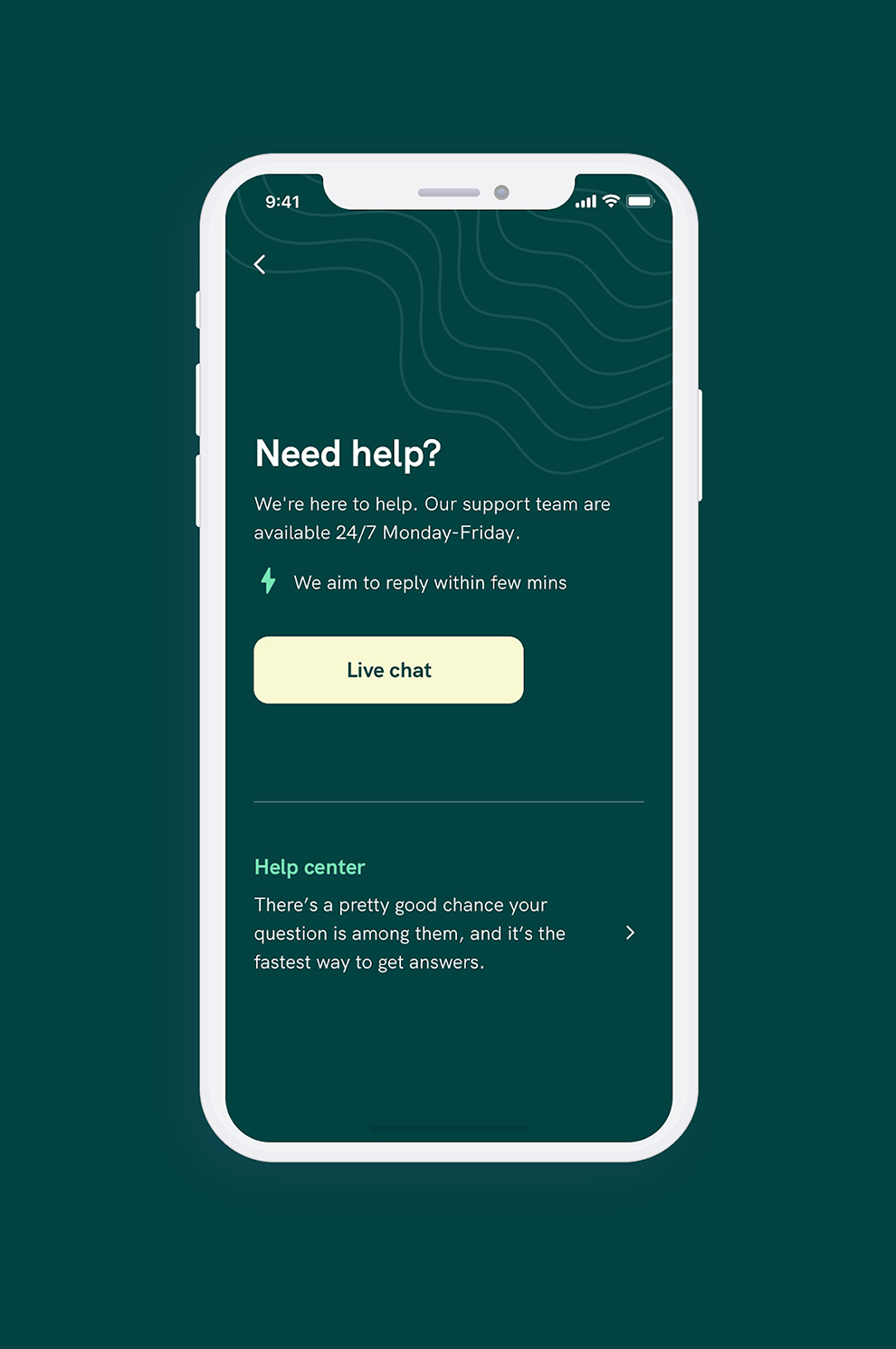

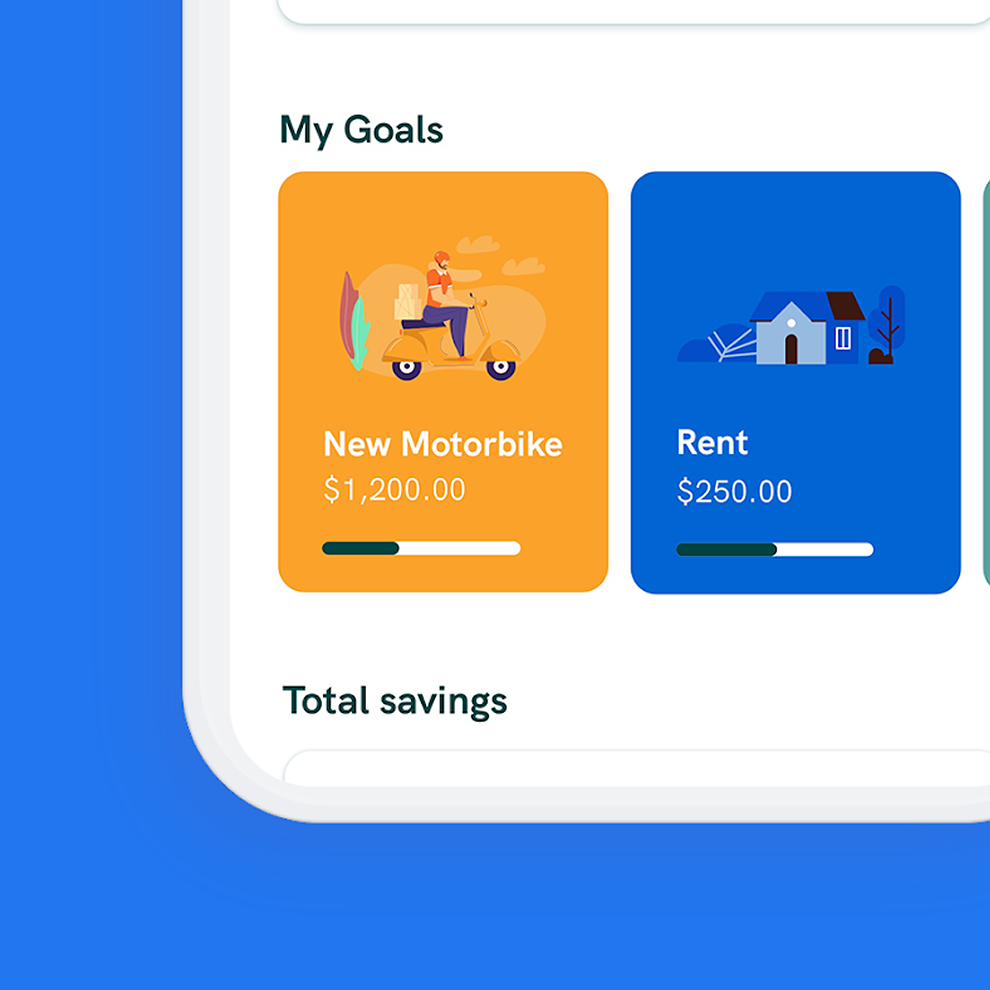

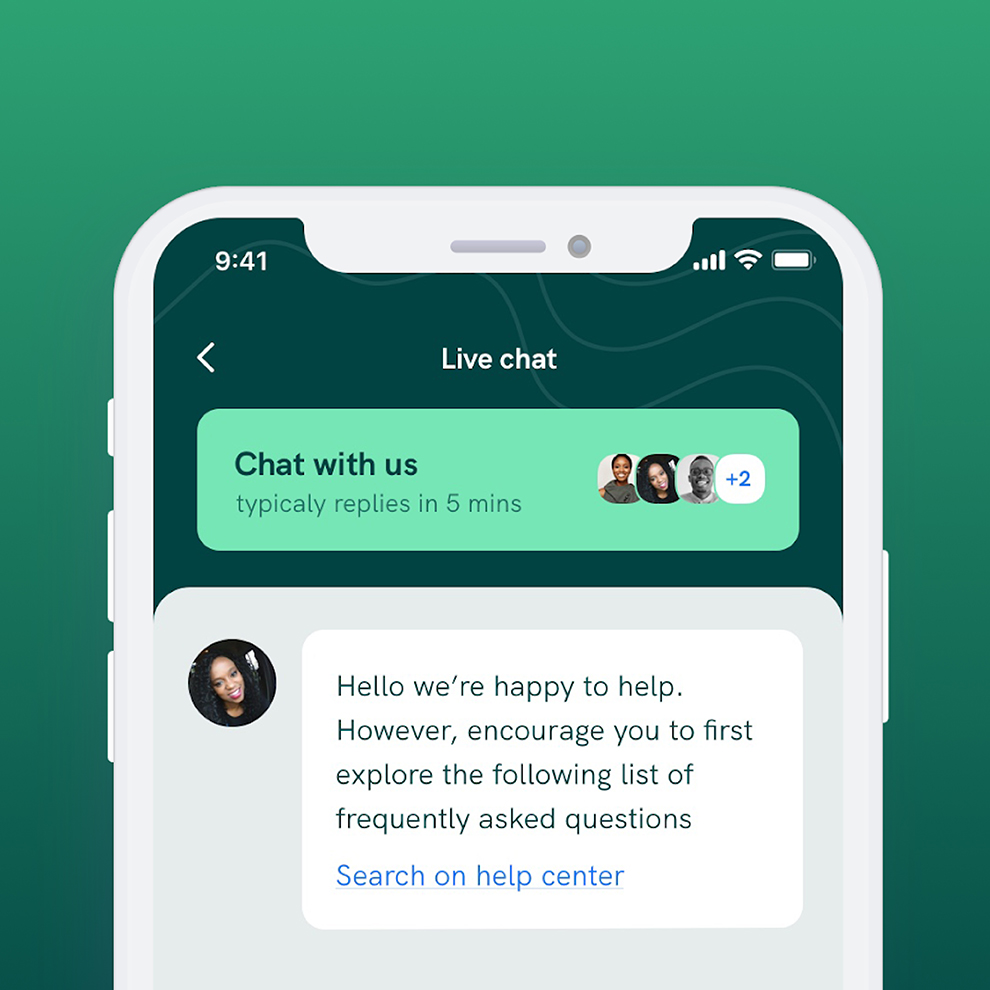

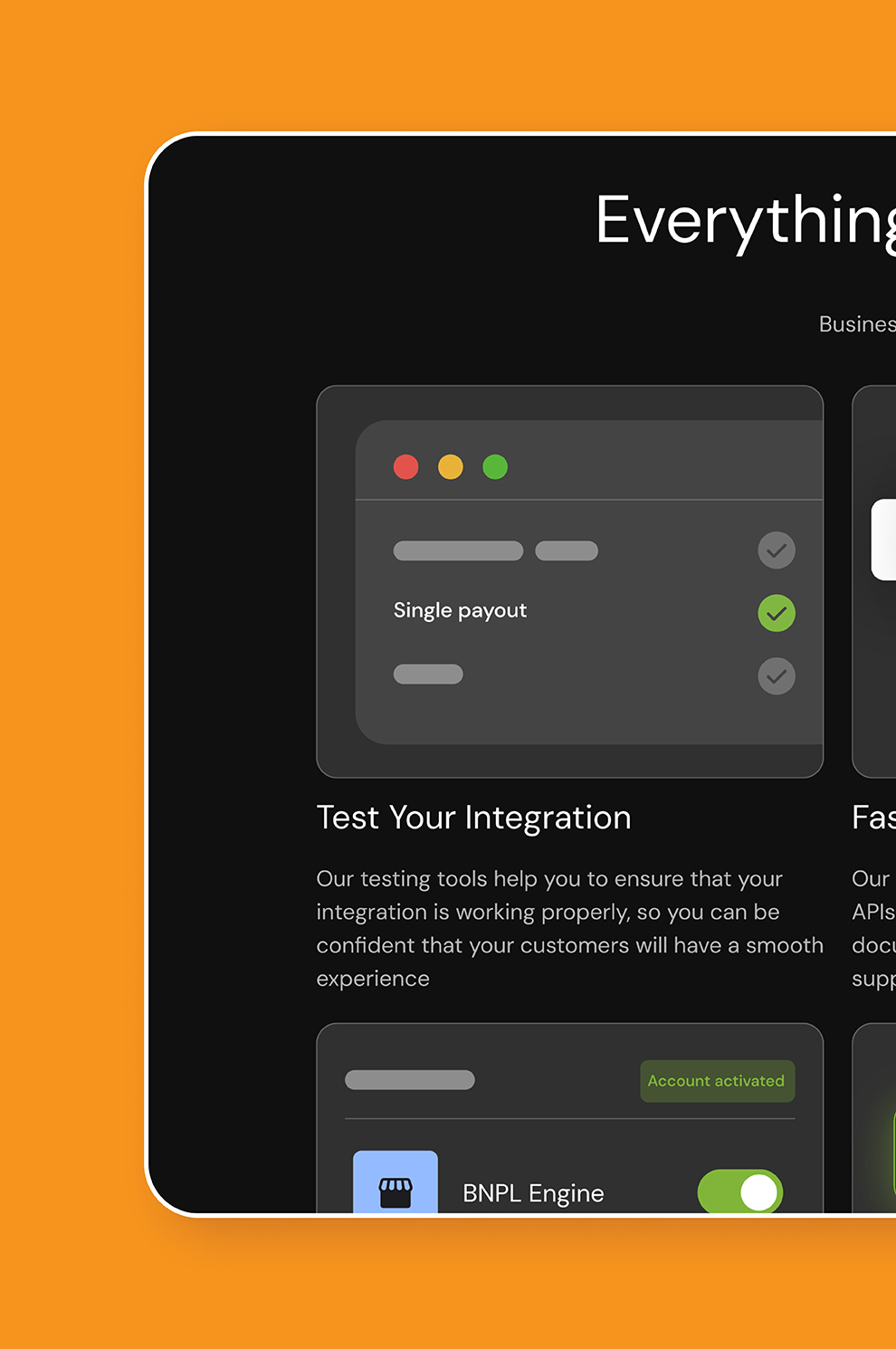

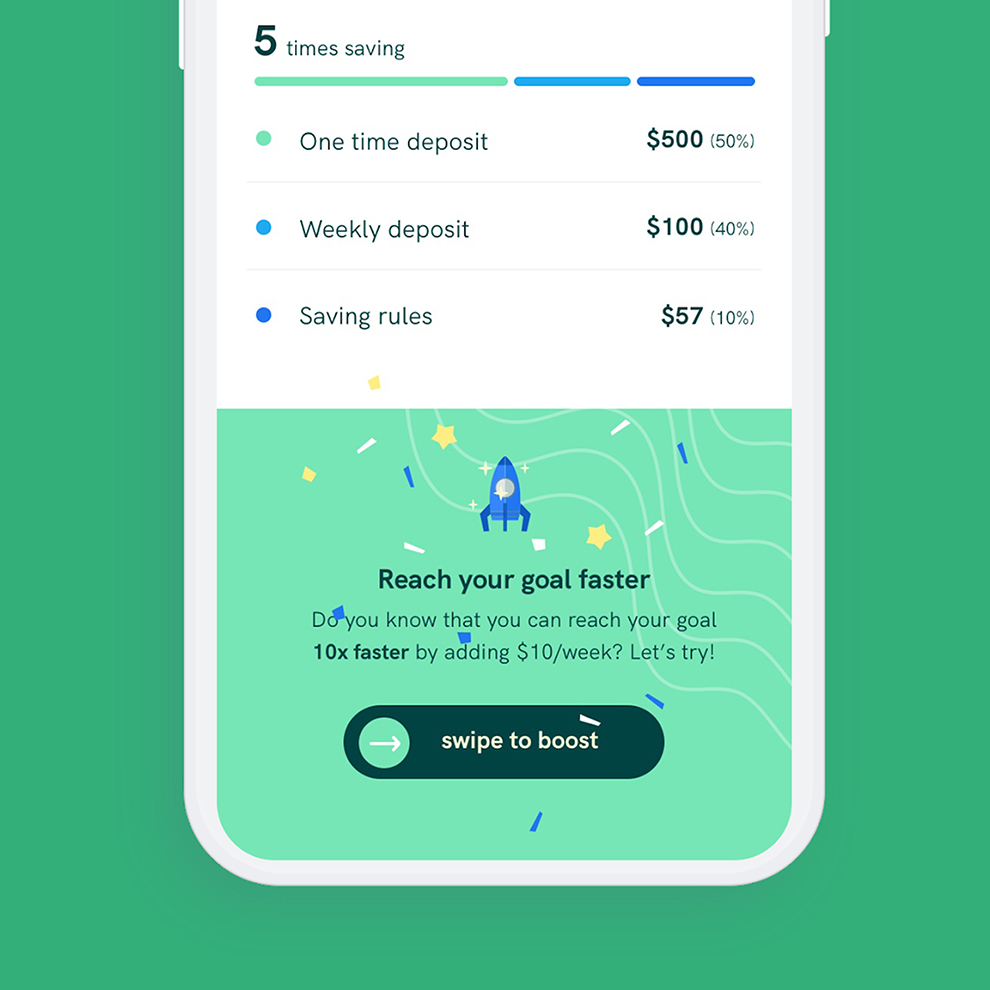

I streamlined the user flow for easy sign-up and tailored onboarding. A financial health assessment guides personalized solutions, including banking options, loans, payment gateways, and trade support. Accessible customer support, a resource section for financial literacy, and frequent usability testing are key features.

The design ensures a clean, fast-loading experience with elements of trust and community, using African-inspired colors. Both platforms employ responsive web design for a consistent cross-device experience. Rigorous testing and security audits safeguard transactions and data. The platform launched incrementally, targeting specific regions and industries initially and expanding gradually.

Conclusion

The platform has successfully addressed the challenges faced by businesses in Africa, providing them with the financial services tools and resources needed to thrive in both local and global markets. Through a user-friendly experience, personalized services, and a commitment to security, the platform has contributed to fostering economic growth and financial inclusivity across the continent.

Regular user feedback and continuous improvements ensure that the platform remains relevant and beneficial to African businesses in the long run.